GRC Compliance for Banks

Simplify GRC compliance for banks with SecurEnds.

Harness the power of automation to streamline GRC compliance for banks, mitigate risk, and ensure security with SecurEnds all-in-one solution.

Best GRC Software for Finance

SecurEnds is the leading solution for financial institutions seeking to automate and simplify governance, risk, and compliance (GRC) processes. Our platform provides a holistic approach to identifying governance and administration (IGA) with tools designed to reduce risk, improve security, and ensure compliance with essential regulatory standards such as SOX, HIPAA, PCI, GDPR, and more.

Key Features

- Cloud security compliance (Microsoft 365, Azure, AWS, GCP)

- Risk and compliance management

- Entitlement management and access requests

- Vendor risk assessments

- Automated user access reviews (UAR)

How SecurEnds Works for Your Teams

Unified View

SecurEnds integrates cloud and on-premises banking data to offer a comprehensive, identity-focused view across financial applications, user access, and potential risks, helping banks stay ahead of security challenges.

Risk Control

Financial institutions can detect and mitigate financial risks early with real-time monitoring of access controls and identity management, ensuring that only authorised persons can access critical banking systems.

Integration

By smoothly integrating with existing banking systems, such as ticketing platforms and cloud services, SecurEnds helps banks to simplify workflows across compliance, IT, and security teams, improving overall operational efficiency.

Automation

Automating manual tasks such as user access reviews, entitlement audits, and compliance reporting, reducing the burden on your teams and maximising efficiency to meet stringent regulatory deadlines.

All-in-One Solution for Identity Governance vs GRC Solution

Identity Governance for Banks

SecurEnds ensures that banks authorised persons only have the right access at the right time, mitigating the risk of unauthorised access and potential fraud.

GRC Solution for Banks

The main objective of the SecurEnds GRC solution is to manage risks, policies, and regulatory compliance across the banking organisation, helping financial institutions to meet strict industry standards like SOX, PCI, and GDPR while minimising security threats.

Why SecurEnds for Banks?

SecurEnds combines identity governance and GRC solutions in the banking sector, offering a unified solution that both manages identity access and ensures your bank’s security, risk management, and regulatory compliance are updated and fully integrated.

A Framework for Financial Services GRC Tools

Security and Compliance Framework:

SecurEnds offers a framework that supports financial institutions in managing complex compliance requirements. This framework integrates automated identity access reviews, entitlement management, and cybersecurity risk assessments for a smooth GRC experience.

Compliance Audits

By automating compliance processes, banks can easily demonstrate adherence to key regulatory standards such as SOX, ISO 27001, PCI DSS, and FFIEC.

A complete and streamlined GRC compliance for banks

SecurEnds provides an integrated platform for financial services to manage compliance requirements, reduce audit fatigue, and improve productivity. We enable financial institutions to focus on growth and security by automating key GRC processes such as access reviews, entitlement management, and vendor risk assessments while ensuring compliance with industry regulations and mitigating operational risks.

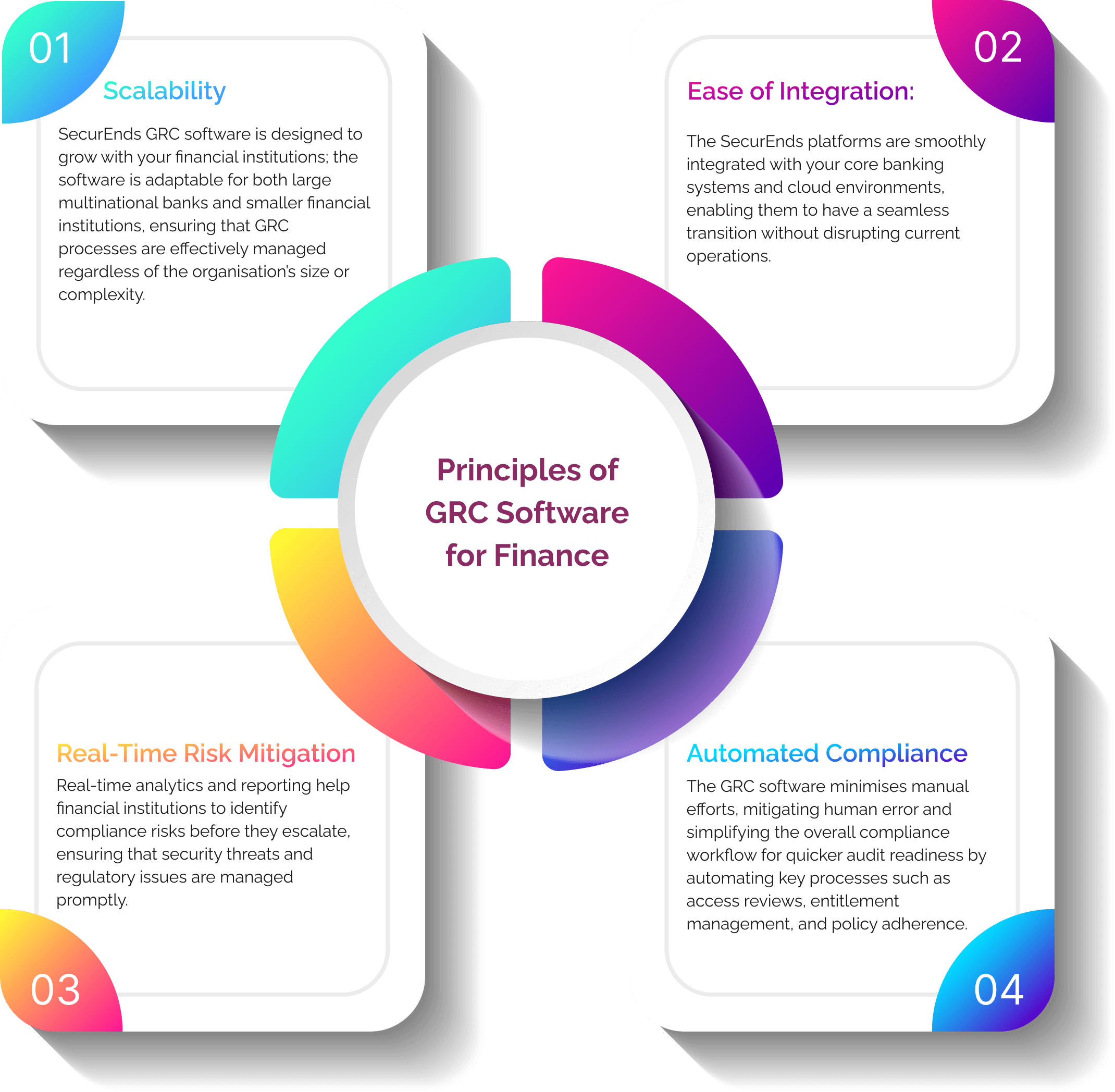

How Does GRC Software for Finance Work?

Continuous Monitoring

Banks benefit from continuous monitoring of user access, entitlements, and sensitive activities. Through this continuous monitoring, banks can easily identify any anomalies or violations that could pose compliance or security risks.

Risk Identification

GRC software for banks constantly detects and assesses the potential risks in real time across all financial platforms, such as cloud services and on-premises systems. This approach helps banks to reduce risks like fraud, unauthorised access, and data breaches.

Reporting & Auditing

This software automates the generation of detailed reports for auditors and simplifies compliance checks; it also ensures that banks can easily provide evidence of adherence to critical regulations and pass financial audits efficiently.

Why Choose SecurEnds GRC Solution?

Enhanced Data Privacy

With the growing significance of data across industries, protecting information with advanced technology has become highly needed for business growth and success. SecurEnds offering of the best GRC software for finance effectively addresses concerns of data privacy and compliance, ensuring that both employees and business data are secured and managed appropriately.

Effective Audit Management

SecurEnds GRC platform automates the audit process, enabling internal audit teams to track and manage all documents related to planning, assessment, evidence recording, and reporting. This ensures a smooth audit system, mitigating manual effort and enhancing efficiency.

Vendor Risk Management

Data breaches often occur through third-party vendors. SecurEnds strengthens data privacy and achieves transparency in every phase of the vendor dealing process, offering a single database that contains all vendor information for easier management, auditing, and monitoring.

Proven Track Record of Success

Over 100 leading financial institutions are empowered by SecurEnds for automating user access reviews, entitlement audits, and access certification, helping them stay secure and reduce risks with unauthorised access.

Ready to enhance GRC compliance for your banks?

Schedule a demo

Frequently Asked Questions

Governance, Risk, and Compliance (GRC) software helps financial institutions manage their compliance, identify risks, and implement policies to ensure regulatory adherence.

SecurEnds automates user access reviews, entitlement audits, and risk assessments, helping banks ensure compliance with regulatory standards while simplifying operations across both cloud and on-premises systems.

SecurEnds supports major compliance standards such as SOX, PCI, HIPAA, ISO 27001, GDPR, and more.

Yes, SecurEnds is a scalable platform suitable for financial institutions of all sizes, offering flexible solutions for both small and large organisations.

SecurEnds combines continuous monitoring, real-time analytics, and automated controls to ensure that security risks are proactively addressed across your systems.