Credit Union Solution

User Access Reviews For Credit Unions

Proudly Serving Federally Insured & State Charter Credit Unions

SecurEnds is empowering credit unions and community banks by providing robust User Access Reviews for Credit Unions, ensuring compliance with NCUA Guidelines and FFIEC standards. Our comprehensive User Access Review and Identity Lifecycle Management solutions help credit unions stay secure and mitigate risks associated with unauthorized access.

Our platform can be rapidly deployed in both on-premise and cloud environments, allowing for flexibility and scalability. With industry-leading flex-connectors, SecurEnds seamlessly integrates with typical credit union applications and service management software. This ensures that your credit union can efficiently manage user access while maintaining compliance and security.

By automating user access reviews and identity management, SecurEnds helps credit unions eliminate manual processes, reduce audit findings, and protect against potential cyber threats. Ensure your credit union’s data security and regulatory compliance with SecurEnds’ User Access Reviews for Credit Unions.

Schedule a Meeting

Why Do I Need It?

Your Credit Union most likely uses a manual process to conduct access reviews. Any remediation (eg deprovision access for terminated employee) is probably done after the fact and manually. This leaves you vulnerable to audit findings and cyber attacks.

What Are The Benefits?

Our User Access Review software takes out the complexity and helps enforce IT controls and compliance mandates.

Why SecurEnds?

Our lightweight, highly configurable and industry first flex-connector product can be easily deployed on your on-prem or cloud in a matter of few hours. Our product an easily bolt on to your existing single -sign-on solution to make a comprehensive end to end identity management solutions

SecurEnds Provides Scalable Identity Governance Solutions for Community Banks and Credit Unions Without Complex Implementation

Salient Features:

- Create single source of truth by connecting to HR systems such as ADP etc

- Automate user access reviews across connected and disconnected applications

- Set up attribute based, one time or periodic, multi approval level access review campaigns.

- Integrate with service management systems (Trackit, ServiceNow, Jira) to orchestrate deprovisioning workflow.

- Generate proof of compliance reports for audit trails.

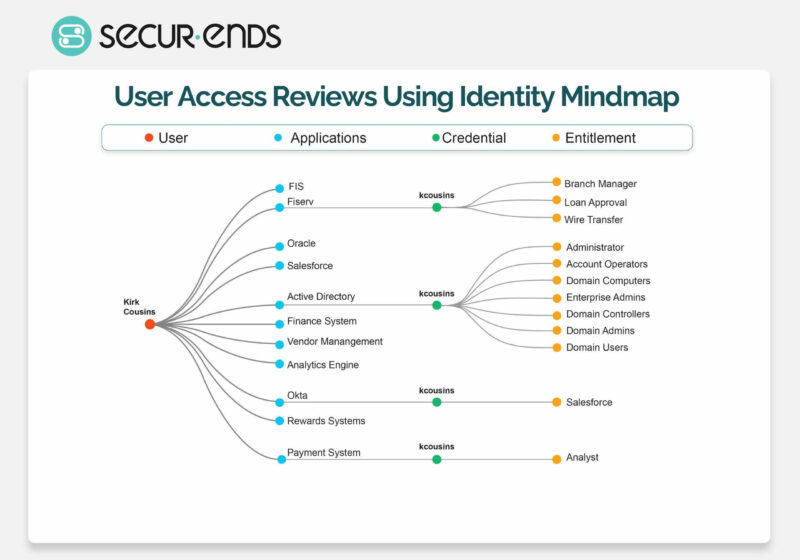

- Ease to drill down identity mind maps for manager to see “who has access to what resource”

Our Solution Allows End To End Identity Management

| Category | SecurEnds | Homegrown |

|---|---|---|

| Data Collection | Connect with enterprise, custom and cloud applications using flex-connectors or csv file upload | Manual data extraction and aggregation of identities |

| Entitlement Discovery | AI enabled discovery of “who has access to what” using identity mind map | Non existent |

| Access Request Workflow | Automated workflows to manage access requests, approval and fulfillment across enterprise systems | Non existent |

| Reminder Notification | Intelligent email reminders with automated to reviewers, managers and end -users | In person or spreadsheet based reminders |

| Access Certification | Intuitive interface that consolidates roles, permissions and credentials across applications one-time or periodically or based on attributes | Manual review of spreadsheets or confirmation emails |

| Segregation Of Duty (SOD) | Proactively create rules that prevent entitlements or roles from being granted to the same person | Non existent |

| Proof Of Compliance Audit Reports | Out of box audit friendly compliance reports | Spreadsheet based |

| Service Management Integration | Out of the box integrations with service management systems (Jira, ServiceNow) | Non integrated workflow |